By going through these CBSE Class 11 Accountancy Notes Chapter 2 Theory Base of Accounting, students can recall all the concepts quickly.

Theory Base of Accounting Notes Class 11 Accountancy Chapter 2

Accounting aims at providing information about the financial performance of a firm to its various users. Accounting information must be reliable and comparable based on some consistent accounting policies, principles, and practices. This calls for developing a proper theory base of accounting.

The importance of accounting theory need not.be over-emphasized as no discipline can develop without a sound theoretical base. The theory base of accounting consists of principles, concepts, rules, and guidelines developed over a period of time to bring uniformity and consistency to the process of accounting and enhance its utility to different users of accounting information.

Apart from these, the Institute of Chartered Accountants of India which is the regulatory body for the standardization of accounting policies in the country has issued Accounting Standards which are expected to be uniformly adhered to, in order to bring consistency in the accounting practices.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles refers to the rules or guidelines adopted for recording and reporting business transactions in order to bring uniformity in the preparation and presentation of financial statements. These principles are also referred to as concepts and conventions.

From the practical viewpoint, various terms such as principles, postulates, conventions, modifying principles, assumptions, basic accounting concepts, etc. have been used interchangeably. However, the principles of accounting are not static in nature. These are constantly influenced by changes in the legal, social and economic environment as well as the needs of the users.

Basic Accounting Concepts

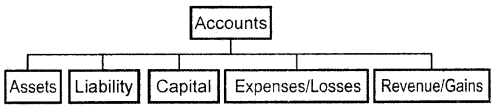

The basic accounting concepts are referred to as the fundamental, ideas or basic assumptions underlying the theory and practice of financial accounting and are broad working rules for all accounting activities and developed by the accounting professions.

The important basic accounting concepts are following:

1. Business Entity Concept: This concept assumes that a business, has a distinct and separate entity from its owners. Thus, for the purpose of accounting, a business and its owners are to be treated as two separate entities.

2. Money Measurement Concept: The concept of money measurement states that only those transactions and happenings in an organization, which can be expressed in terms of money are to be recorded in the books of accounts. Also, the records of the transactions are to be kept not in the physical units but in the monetary units.

3. Going Concern Concept: This concept assumes that a business firm would continue to carry out its operations indefinitely (for a fairly long period of time) and- would not be liquidated in the near future.

4. Accounting Period Concept: The accounting period refers to the span of time at the end of which the financial statements of an enterprise are prepared to know whether it has earned profit or incurred losses during that period and what exactly is the position of its assets and liabilities, at the end of that period.

5. Cost Concept: The cost concept requires that all assets are recorded in the book of accounts at their cost price, which includes the cost of acquisition, transportation, installation, and making the assets ready for use.

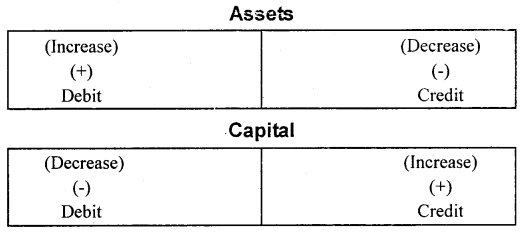

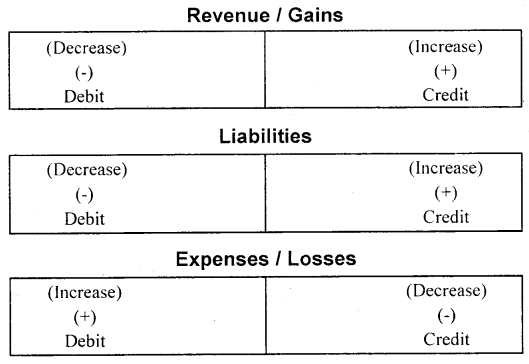

6. Dual Aspect Concept: This concept states that every transaction has a dual or two-fold effect on various accounts and should therefore be recorded in two places. The duality principle is commonly expressed in terms of fundamental accounting equations, which is

Assets = Liabilities + Capital

7. Revenue Recognition (Realisation) Concept: Revenue is the gross inflow of cash arising from the sale of goods and services by an enterprise and use by others of the enterprise’s resources yielding interest royalties and dividends. The concept of revenue recognition requires that the revenue for business transactions should be considered realized when a legal right to receive it arises.

8. Matching Concept: The concept of matching emphasizes that expenses incurred in an accounting period should be matched with revenues during that period. It follows from this that the revenue and expenses incurred to earn this revenue must belong to the same accounting period.

9. Full Disclosure Concept: This concept requires that all material and relevant facts concerning the financial performance of an enterprise must be fully and completely disclosed in the financial statements and their accompanying footnotes.

10. Consistency Concept: This concept states that accounting policies and practices followed by enterprises should be uniform and consistent over a period of time so that results are composable. Comparabilities results when the same accounting principles are consistently being applied by different enterprises for the period under comparison, or the same firm for a number of periods.

11. Conservatism Concept: This concept requires that business transactions should be recorded in such a manner that profits are not overstated. All anticipated losses should be accounted for but all unrealized gains should be ignored.

12. Materiality Concept: This concept states that accounting should focus on material facts. If the item is likely to influence the decision of a reasonably prudent investor or creditors, it should be regarded as material, and shown in the financial statements. 13. Objectivity Concept: According to this concept, accounting transactions should be recorded in the manner so that it is free from the bias of accountants and others.

Systems of Accounting:

There are two systems of recording business transactions which are following:

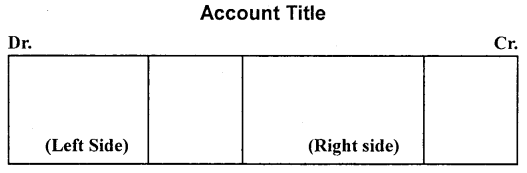

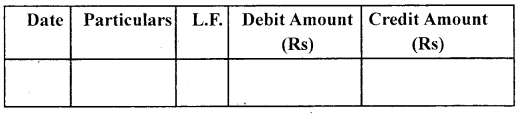

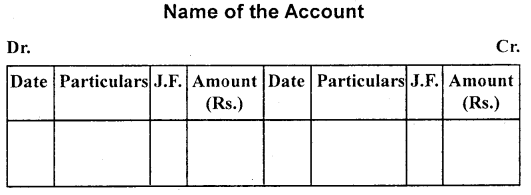

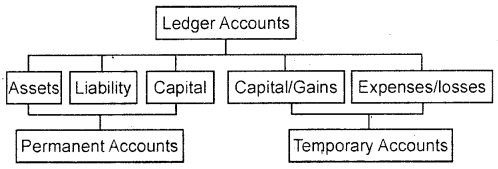

1. Double Entry System: This system is based on the principle of “Dual Aspect” which states that every transaction has two effects, viz. receiving of a benefit and giving of a benefit. Each transaction, therefore, involves two or more accounts and is recorded at different places in the ledger. The basic principle followed is that every debit must have a corresponding credit. A double-entry system is a complete system as both the aspects of a transaction are recorded in the books of accounts.

2. Single Entry System: This system is not a complete system of maintaining records of financial transactions. It does not record the two-fold effect of each and every transaction. Instead of maintaining all the accounts, only personal accounts and cash books are maintained under this system. The accounts maintained under this system are incomplete and unsystematic and, therefore, not reliable.

Basis of Accounting

From the point of view of the timing of recognition of revenue and costs, there can be two broad approaches to accounting. These are:

- Cash basis

- Accrual basis

1. Cash Basis of Accounting: Under the cash basis, entries in the book of accounts are made when cash is received or paid and not when the receipt or payment becomes due. This system is incompatible with the matching principle, which states that the revenue of a period is matched with the cost of the same period.

2. Accrual Basis of Accounting: Under the accrual basis, revenue and costs are recognized in the period in which they occur rather than when they are paid. A distinction is made between the receipt of cash and the right to receive cash and payment of cash and the legal obligation to pay cash. Thus, under this system, the monitory effect of a transaction is taken into account in the period in which they are earned rather than in the period in which cash is actually received or paid by the enterprise.

Accounting Standards:

Accounting standards are written statements of uniform accounting rules and guidelines or practices for preparing the uniform and consistent financial statements and for other disclosures affecting the user of accounting information. However, the accounting standards cannot override the provision of applicable laws, customs, usages, and business environments in the country.

Kohler defines accounting standards as “a mode of conduct imposed on accountants by custom, law or professional body”.

In order to bring uniformity and consistency in the reporting of accounting information, the Institute of Chartered Accountants of India (ICAI) constituted an Accounting Standard Board in April 1977 for developing Accounting Standards. Accounting Standard Board submits the draft of the standards to the council of ICAI, which finalizes the accounting standards.

Accounting-Standards (AS):

The ICAI has issued the following standards:

- AS 1 Disclosure of Accounting Policies

- AS 2 Valuation of Inventories

- AS 3 Cash Flow Statements

- AS 4 Contingencies and Events Occurring after the Balance Sheet Date

- AS 5 Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies

- AS 6 Depreciation Accounting AS 7 Construction Contracts

- AS 8 Accounting for Research and Development

- AS 9 Revenue Recognition

- AS 10 Accounting for Fixed Assets

- AS 11 The Effects of Changes in Foreign Exchange Rates

- AS 12 Accounting for Government Grants

- AS 13 Accounting for Investments

- AS 14 Accounting for Amalgamations

- AS 15 Accounting for Retirement Benefits in the Financial Statements of Employers (recently revised and titled as Employee Benefits’)

- AS 16 Borrowing Costs

- AS 17 Segment Reporting

- AS 18 Related Party Disclosures

- AS 19 Leases

- AS 20 Earnings Per Share

- AS 21 Consolidated Financial Statements

- AS 22 Accounting for Taxes on Income

- AS 23 Accounting for Investments in Associates in Consolidated Financial Statements

- AS 24 Discontinuing Operations

- AS 25 Interim Financial Reporting AS 26 Intangible Assets

- AS 27 Financial Reporting of Interests in Joint Ventures AS 28 Impairment of Assets

- AS 29 Provisions. Contingent Liabilities and Contingent Assets

International Financial Reporting Standards (IFRS):

“International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB), the international accounting standard-setting body, which came into existence in the year 2001.

The use of a single set of high-quality accounting standards would facilitate investment and other economic decisions across borders, increase market efficiency and reduce the cost of capital. IASB places emphasis on developing standards based on sound and clearly stated principles, from which interpretation is necessary. Therefore, IFRS are referred to as principles-based accounting standards.

IFRS issued by the IASB:

| S.No. | Title |

| 1. IFRS 1 | First-time Adoption of International Financial Reporting Standards. |

| 2. IFRS 2 | Share-Based Payment |

| 3. IFRS 3 | Business Combinations |

| 4. IFRS 4 | Insurance Contracts |

| 5. IFRS 5 | Non-Current Assets Held for Sale and Discontinued Operations |

| 6. IFRS 6 | Exploration for and Evaluation of Mineral Resources |

| 7. IFRS 7 | Financial Instruments: Disclosures |

| 8. IFRS 8 | Operating Segments |

| 9. IFRS 9 | Financial Instruments |

| 10. – | IFRS for Small and Medium Enterprises. It provides standards applicable to private entities (those that are not publicly accountant as defined in this standard) |

IASB has adopted all outstanding IAS and SIC issued by the IASC as its own standards. Those IAS and SIC continue to be in force to the extent they are not amended or withdrawn by the IASB. Out of 41 IAS, 12 IAS standards withdrawn and in effect 29 IAS are still applicable.

IFRS compliant financial statements are:

- Statement of Financial Position,

- Comprehensive Income Statement,

- Statement of Changes in Equity,

- Statement of Cash Flow, and

- Notes and Summary of Accounting Policies.

Difference between IFRS and Indian Accounting Standards:

The principal difference between the two is that while IFRS is based on principle and fair value. Indian Accounting Standards are based on rules and historical value.